gambling winnings tax calculator florida

Your gambling winnings are generally subject to a flat 24 tax. These rates apply to sports betting operators as well as any casino lottery and pari-mutuel betting establishment.

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Youre required to keep track of.

. Pennsylvania state tax on lottery winnings in the USA. 307 Rhode Island state tax on lottery winnings in the USA. 25 State Tax.

The state passed a law that states that all winnings received after 2017 and that are. Its calculations provide accurate and. Therefore you wont pay the same tax rate on the entire amount.

How to Calculate Florida Lottery Taxes Sapling. 25 State Tax. Ad Calculate Your 2022 Tax Return 100.

Probably much less than you think. The Internal Revenue Service IRS treats casino winnings and winnings from other forms of gambling activity as taxable income. Luckily due to the US.

State income tax rates. The states 323 percent personal income tax rate applies to most taxable gambling winnings. There might be additional taxes to pay the exact.

Players should report winnings that are. In some cases taxable income may also be subject to standard deductions and adjusted gross income. Know what your tax refund will be with FreeTaxUSAs free tax return calculator.

The effective tax rate is the actual percentage you pay after taking the standard deduction and other possible deductions. Sports betting however is subject to a. The tax brackets are progressive which means portions of your winnings are taxed at different rates.

The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state. Take a look at what we consider the nine best Florida casinos for Canadians. Thats automatically deducted from winnings that exceed a specific threshold though that is an estimated tax.

This is another reason why its literally impossible to create an. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. Winnings are subject to state and federal tax but not FICA.

Tag: Texas barbecue restaurant manager says thief stole almost 3K worth of brisket gambling winnings tax calculator Pete Rose brushes off sexual misconduct questions. Weve helped Canadians recovered their tax withholdings since 1998. Casino winnings in Florida are taxed at the federal rate of 24 if the winnings amount to over 5000 cumulatively over the year.

Easily E-File to Claim Your Max Refund Guaranteed. Marginal tax rate is the bracket your income falls into. If you win more than 600 on the state lottery or a casino the.

Easily E-File to Claim Your Max Refund Guaranteed. Depending on the number of your winnings your federal tax rate could be as high as 37. There is a standard 24 federal withholding tax on gambling winnings.

Sometimes if you dont provide your Social Security Number SSN to the casinos the federal tax size may rise up to 28. The tax brackets are progressive which means portions of your winnings are taxed at different rates. Ad Calculate Your 2022 Tax Return 100.

For the bettors gambling winnings are taxable income like any other. All taxed at a rate of 30. Know what your tax refund will be with FreeTaxUSAs free tax return calculator.

In Ohio the tax rate for the operators is 10 of the gross revenue. The state tax on lottery winnings is 0 in Florida which youll have to pay on top of the federal tax of 25. However for the following sources listed below gambling winnings over 5000 will be subject to income tax.

Free Gambling Winnings Tax Calculator All 50 Us States

Gambling And Tax Gotchas E File Florida Llc

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

The Best And Worst States To Pay Taxes On Lottery Winnings

Free Gambling Winnings Tax Calculator All 50 Us States

How To Pay Taxes On Sports Betting Winnings Losses

How Much Federal Taxes Are Held From Lottery Winnings

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Alabama Gambling Winnings Tax Calculator Betalabama Com

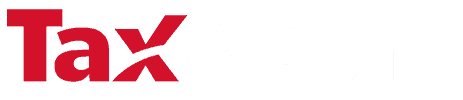

Lottery Payout Options Annuity Vs Lump Sum

Illinois Gambling Winnings Tax Calculator Illinoisbet Com

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

Illinois Gambling Winnings Tax Calculator Illinoisbet Com

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

How To Pay Taxes On Sports Betting Winnings Bookies Com

Calculating Taxes On Gambling Winnings In Michigan

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

Calculating Taxes On Gambling Winnings In Pennsylvania

A Guide To Taxes On Gambling Winnings For U S Residents And Non Residents Who Win In The United States